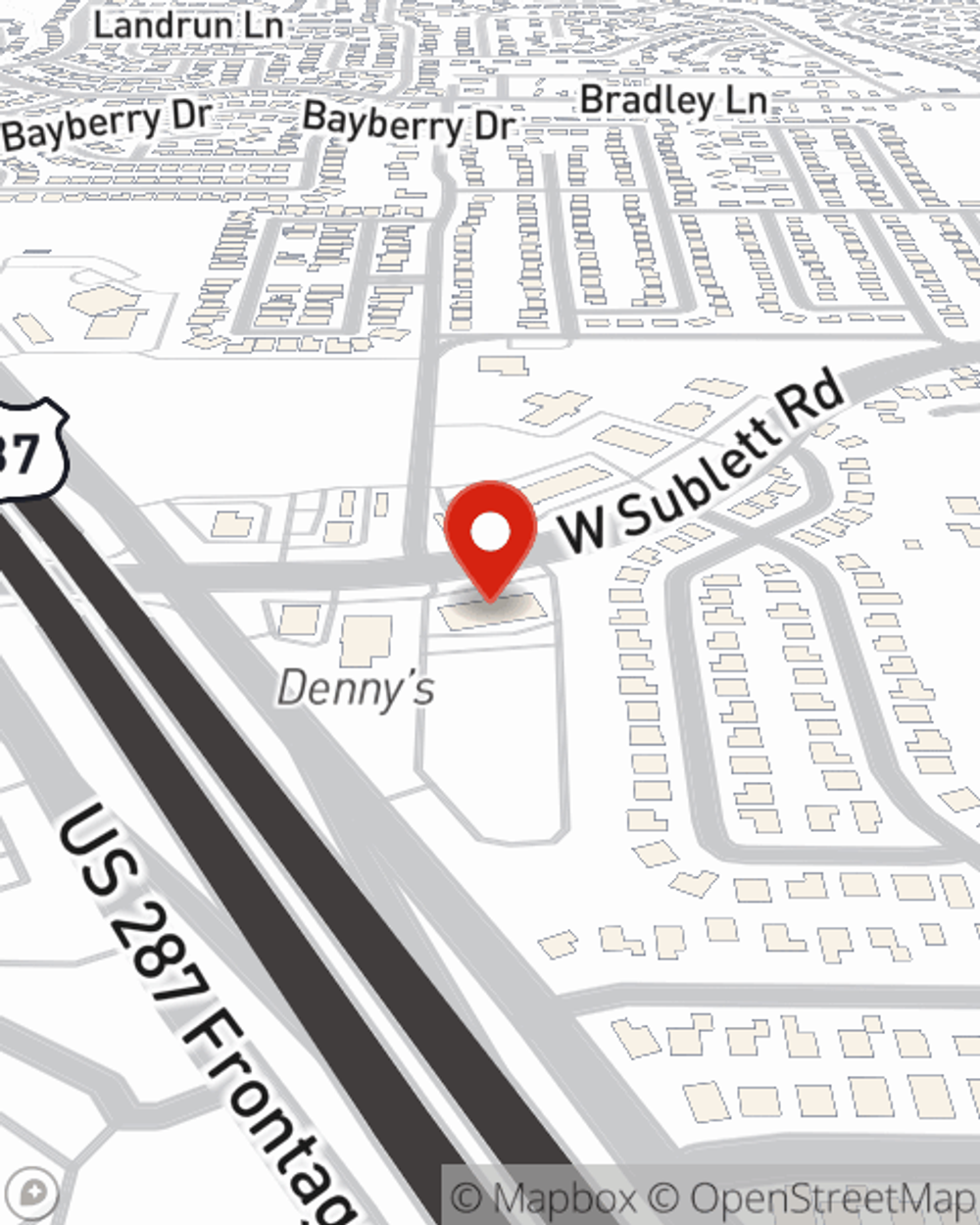

Life Insurance in and around Arlington

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

- DALLAS

- FORT WORTH

- ARLINGTON

- MANSFIELD

- CEDAR HILL

- GRAND PRAIRIE

- KELLER

- SHREVEPORT

- LITTLE ROCK

- NORTH RICHLAND HILLS

- McKINNEY

- TARRANT COUNTY

- BEDFORD

- WEATHERFORD

- WAXAHACHIE

- BOSSIER CITY

- OKLAHOMA CITY

- KERRVILLE

- CADDO PARRISH

- MENIFEE

- ELK CITY

- SAN ANTONIO

- HOUSTON

- TYLER

Check Out Life Insurance Options With State Farm

Purchasing life insurance coverage can be a lot to consider with many different options out there, but with State Farm, you can be sure to receive compassionate considerate service. State Farm understands that your primary reason is to help provide for the ones you hold dear.

Protection for those you care about

Life happens. Don't wait.

Love Well With Life Insurance

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you pick will depend on your current and future needs. Then you can consider the cost of a policy, which is calculated using your current age and your health status. Other factors that may be considered include family medical history and gender. State Farm Agent Isaiah Whitaker can walk you through all these options and can help you determine how much coverage you need.

To explore State Farm's Life insurance options, reach out to Isaiah Whitaker's office today!

Have More Questions About Life Insurance?

Call Isaiah at (682) 587-2645 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Isaiah Whitaker

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.